|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Current Mortgage Rates in AZ: Exploring Your OptionsUnderstanding the current mortgage rates in Arizona is crucial for anyone considering buying a home or refinancing their existing mortgage. With rates fluctuating, it’s important to stay informed to make the best financial decision. Overview of Mortgage RatesMortgage rates in Arizona, like in other states, are influenced by various factors including the economy, the Federal Reserve's monetary policy, and housing market trends. As of now, rates are relatively stable but subject to change. Factors Affecting Rates

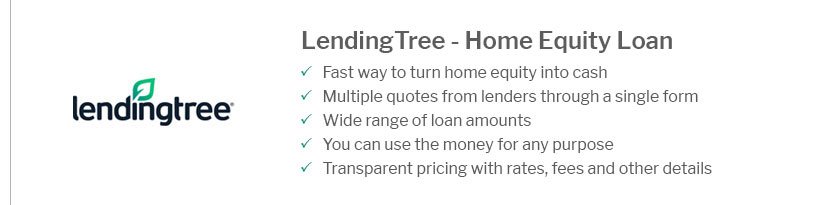

Comparing Loan OptionsWhen considering a mortgage, it's helpful to compare different loan options. For instance, fixed-rate mortgages provide stability with consistent payments, while adjustable-rate mortgages may offer lower initial rates. For those interested in refinancing, exploring texas lending refinance rates might provide additional insights into beneficial options. Popular Mortgage Options

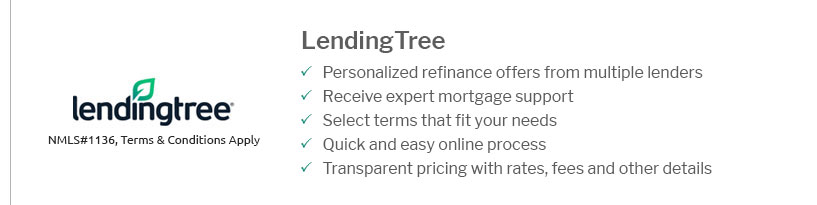

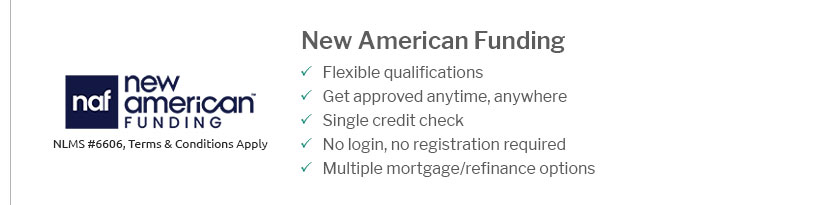

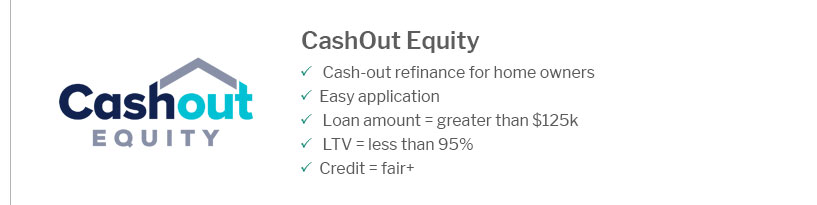

Finding the Best RatesTo find the best mortgage rates, it's essential to shop around and compare offers from different lenders. Keep in mind that the lowest rate isn’t always the best deal; consider the terms and fees associated with each loan. Those looking for options beyond Arizona can also check lowest jumbo mortgage rates to explore larger loan options that may fit their needs. FAQ

https://www.nerdwallet.com/mortgages/mortgage-rates/arizona

Today's mortgage rates in Arizona are 6.802% for a 30-year fixed, 5.977% for a 15-year fixed, and 7.094% for a 5-year adjustable-rate mortgage (ARM). Check out ... https://www.zillow.com/mortgage-rates/az/

The current average 30-year fixed mortgage rate in Arizona decreased 3 basis points from 6.85% to 6.82%. Arizona mortgage rates today are 2 basis points lower ... https://www.bankrate.com/mortgages/mortgage-rates/arizona/

Current mortgage rates in Arizona. As of Thursday, March 20, 2025, current interest rates in Arizona are 6.81% for a 30-year fixed mortgage and 0.00% for a 15- ...

|

|---|